Know the Cost of Relocation Before They Go

Let’s discuss a very real problem that global mobility professionals experience. U.S.-based Jetstar Electronics, a fictional company, had been assigning executives to its global subsidiaries for so long, it became routine…until one year it wasn’t.

What changed is that Jetstar began incentivizing executives with stock. The company was unaware its stock awards, even though made within the U.S., could be considered income subject to foreign tax if vested while an employee was on overseas assignment.

Under tax equalization, the employer is generally responsible for foreign taxes in excess of what an employee would incur at home – so Jetstar had millions of dollars in unexpected costs. These costs hit months or even years after employees repatriated, sometimes even after an employee left the company.

Earnings took a surprise hit and bonuses were cut. There were even lawsuits between some ex-employees and the company disputing who was responsible for the unpredicted tax payments.

Could your company’s mobility program be facing these perils – or other ones?

The need for better pre-assignment estimates.

The costs of deploying an executive internationally are high, and the financial controls are often insufficient for the task at hand. According to research from Mercer:

- A typical expat package costs 2.5 times an individual’s base salary. That’s $1.5 million for a $200,000 executive on a 3-year assignment.

- Only about two thirds of European and North American firms make detailed estimates with “a worrying number of multinationals still relying on rough calculations only.”

- 54% of companies do not even track actual global mobility expenses against the forecasts.

Clearly, there is a lot of room for improvement, even in large multinational corporations with years of global mobility experience.

What’s involved in a best-practices estimation?

- Comprehensive estimate. The estimate covers the entire length of the assignment, through repatriation, including benefits, incentives, entitlements and all resulting tax liabilities.

- Latest data. Tax rates and rules, living costs and exchange rates are always changing. Estimates based on prior years’ experience can be way off-target.

- Track against actual costs. There’s little point in making an estimate if you don’t routinely track and report actual costs vs. projections.

- Map to corporate policy. To avoid disputes, estimates need to be consistent with a written relocation policy clearly delineating costs borne by the employer and employee.

- Common platform. To assure consistency, standardize estimating on a software platform that works across geographies, currencies and languages

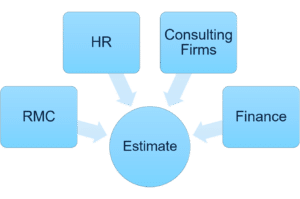

Key Information Sources for Cost Estimates

- Finance Department – Employee salary, incentives and other compensation.

- Relocation Management Company (RMC) – Moving, housing, schools, travel and other relocation-required services.

- HR Department – Company relocation policy.

- Consulting Firms – Tax logic, cost-of-living data, regulatory and management guidance.

Estimate before you invest…financially or emotionally

The time to prepare a cost estimate is at the planning stage of an assignment, when ample data leads to informed decision making about assignment viability. Only when the stakeholders know the real costs, can they weigh the potential return on the proposed investment.

Finally, consider the emotional investment that begins once a supervisor even starts to discuss an international assignment with the employee. The employee may well see this as a career-changing moment. Be sure you can justify the cost, before you raise up their hopes.

What happens next?

Based on the estimate, the company or its global mobility consultant generates the following documents:

- Assignment Letter: This contractual agreement lists the approved compensation and entitlements between the employer and employee and should be reviewed by counsel before signing by each party.

- “Balance Sheet”: The balance sheet reports the periodic compensation to be delivered to the employee as agreed to at assignment initiation. It can be updated if compensation components change during the assignment period. The balance sheet is intended to be shared with the assignee and payroll department.

- Payroll Instructions: The compensation reported on the balance sheet is translated into payroll instructions, segregated into instructions for each entity paying the individual during their assignment.

Follow-through is every bit as important as the initial estimate and documentation. As mentioned earlier, it’s important to monitor actual expenses during an assignment against budgeted amounts.

Certain expenses, especially calculated taxes, should be accrued for in the proper periods; however, relief of those expenses may not occur until well after the assignment has ended. The timing depends on the home and host countries involved, assignment length, compensation and assignment entitlements. Close attention to costs and tax liability – before, during and after the assignment – must be the rule.

Key Benefits

Accurate cost estimates help identify potential cost savings while eliminating unpleasant surprises. Finance and HR departments advance their cause by controlling tax, compensation and entitlement costs, and supporting the company’s relocation policy.

Further, good estimation provides a powerful mechanism to share cost expectations across business units for understanding of – and agreement to – the financial implications of the assignment.

While financial implications are important, the most successful mobility programs consider the human factors first and foremost, e.g. cultural fit and family happiness. Preparation of the cost estimate should trigger pursuing these considerations and their associated expenses, ultimately leading to the approval or disapproval of the assignment.

How does Ineo TechSuite support estimation best practices?

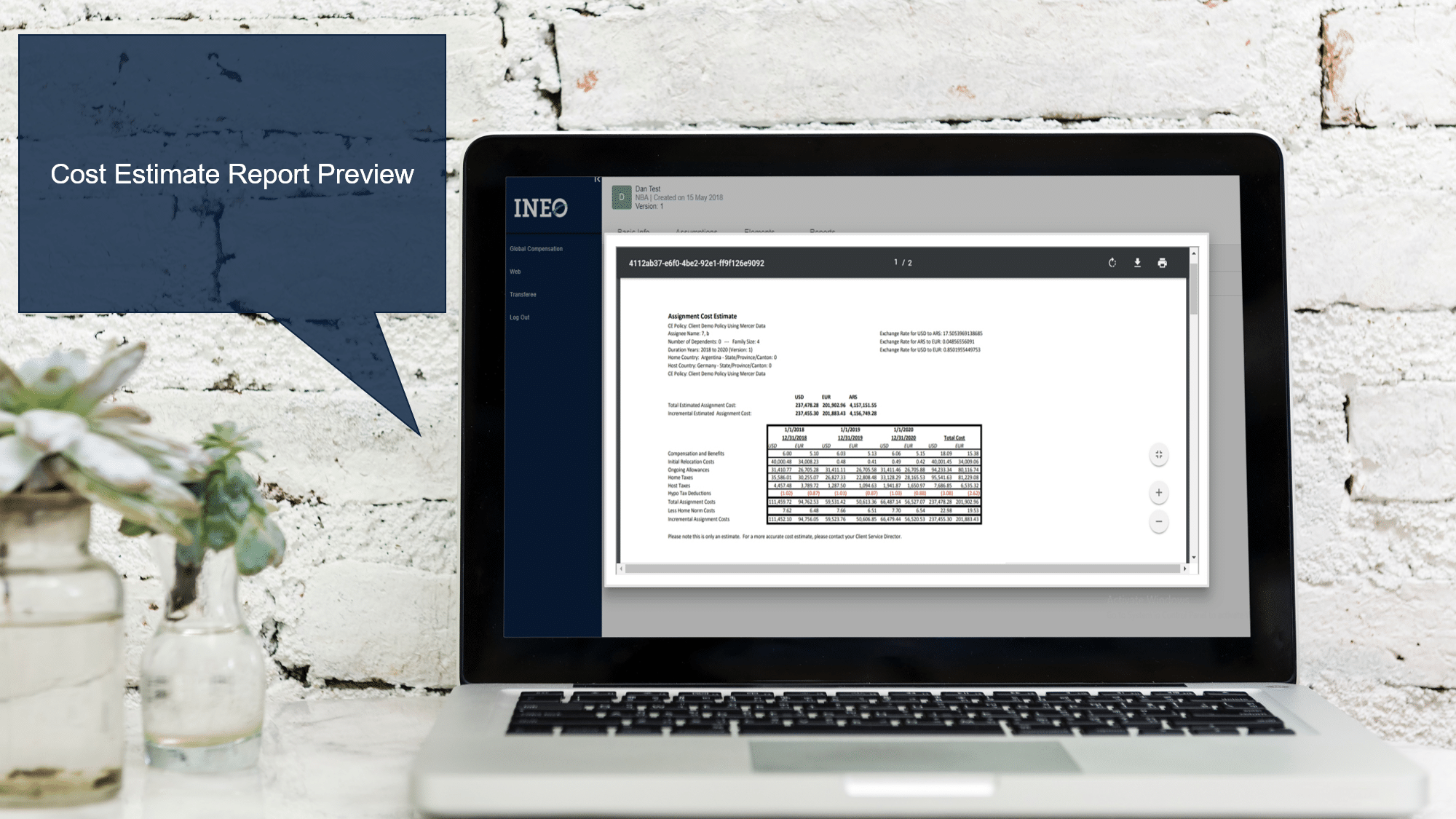

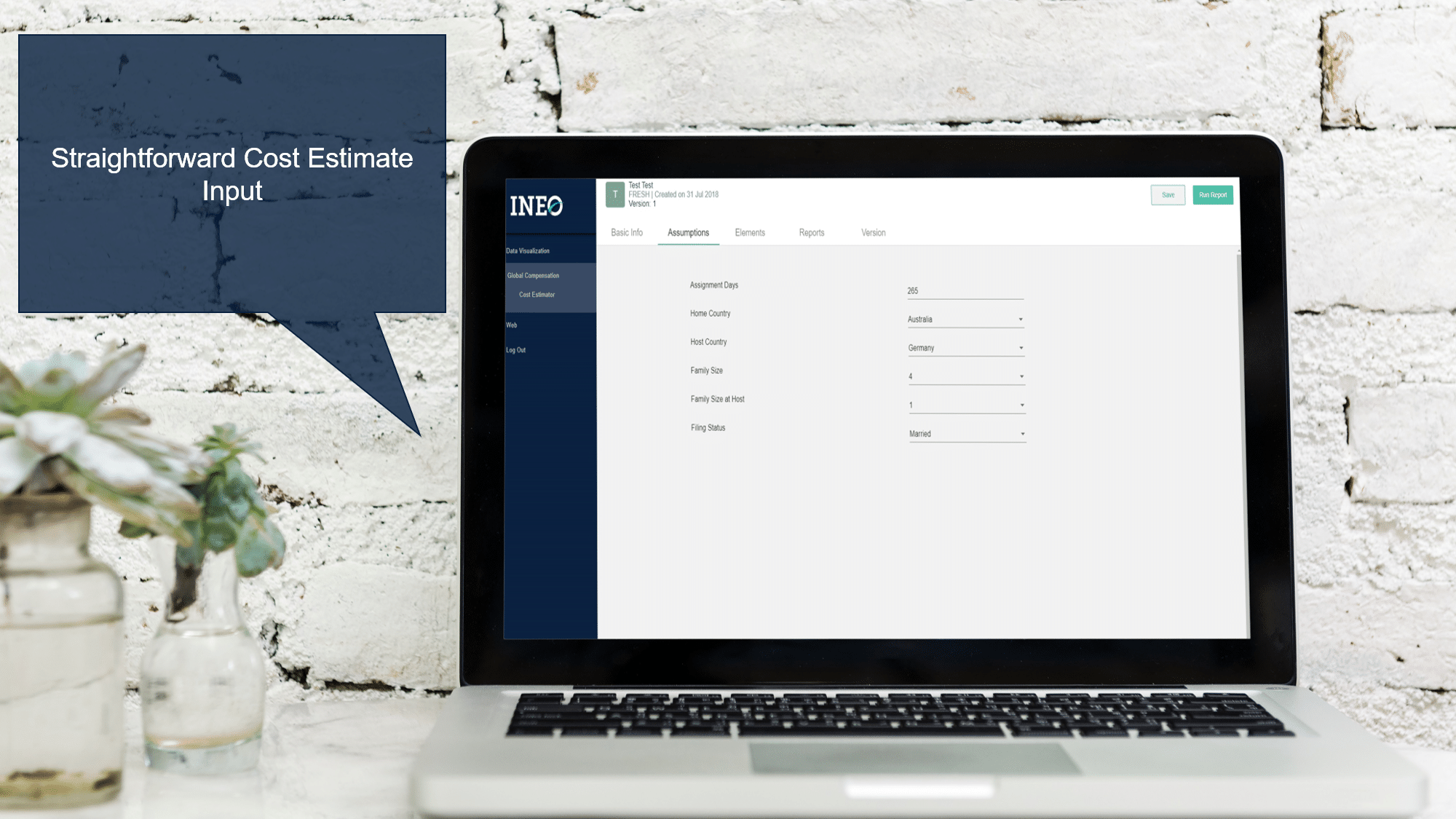

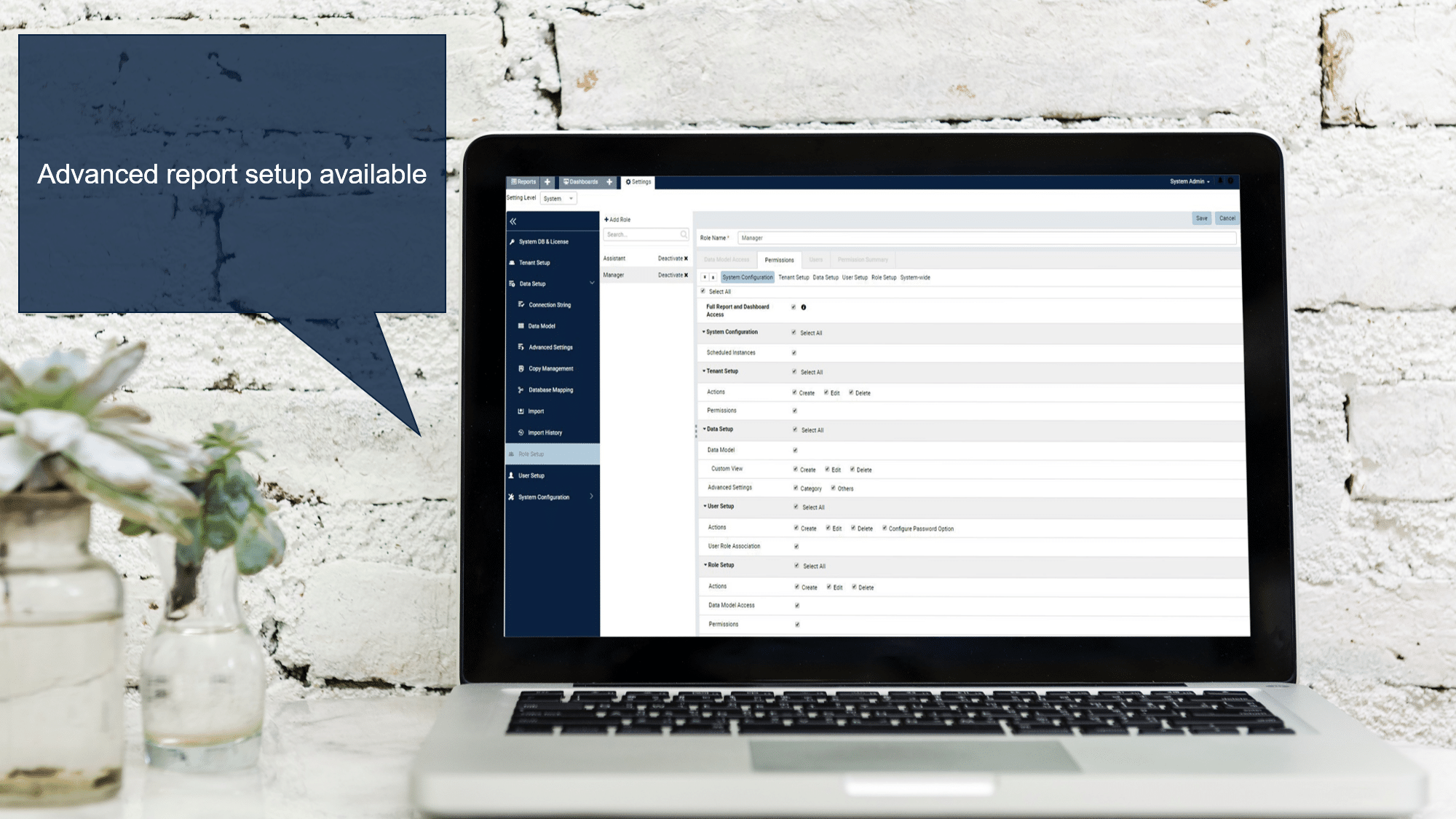

Tech Suite is software for end-to-end management of global mobility assignments, including a robust and easy-to-use Cost Estimator. Here are the key features pertaining to cost estimation:

- Multi-lingual: Tech Suite enables data entry and reporting in languages including English, French, German and Mandarin Chinese.

- Multi-geography: Tax logic available for 85+ countries.

- Dual option: Accessible either with standard policies and compensation for quick results, or in a full-service model enabling customization of policies and compensation.

- Local or cloud-based: The full-service model can be hosted either in local environment or in the cloud (via website). The standard model is available in the cloud only.

- 3rd party data: Both standard and full-service options link with third-party service providers including Mercer and AIRINC.

- Highly flexible: Supports long and short-term assignments, permanent transfer and localizations with line items available for basic compensation, initial relocation costs, ongoing allowances and repatriation costs.

- Tax equalization: Calculates current year gross-up and a variety of tax equalization methods.

- Social Security: Includes employer Social Security cost results with standard estimate.

- Timely tax updates: tax logic updated promptly when local legislation has changed.

- Easy output: Results output can be generated in pdf or Excel format.

Global Mobility Resources

Learn more about what’s going on at Ineo and insights into the complex world of global mobility from the industry’s top thought leaders and innovators.

Request A Demo

Whether you are new to the world of global mobility or you’ve been in the business for a while, Ineo is here to assist you.

The best way to learn how Ineo’s global mobility software can help your company revolutionize your global mobility program and support your business strategy is to see it in a demo.

Fill out this form to get started today.

Get Started