The Tax and Mobility Parallel

The Tax and Mobility Parallel

Taxes and compliance are often the most complex part of the relocation process, especially in a time where it seems every week there is a new tax guideline or rate change impacting an already complex payroll and tax compliance process. Since the passing of the Tax Cuts and Jobs Act (TCJA) of 2017, the mobility industry saw increased compliance issues as professionals tried to understand the changes and adjust their programs to follow these new laws. Limitations on state and local tax deductions, the inclusion of moving expenses in W-2 income, and states incorporating provisions of the federal tax codes into their own code have made balancing compliance, controlling costs, and maintaining transferee satisfaction challenging to say the least. Consulting with a mobility tax professional about tax compliance and gross-up processes will assure you of not only employee’s satisfaction but payroll’s compliance with these new tax laws. Let’s discuss some cost saving strategies you can bring to your tax adviser to maximize your partnership.

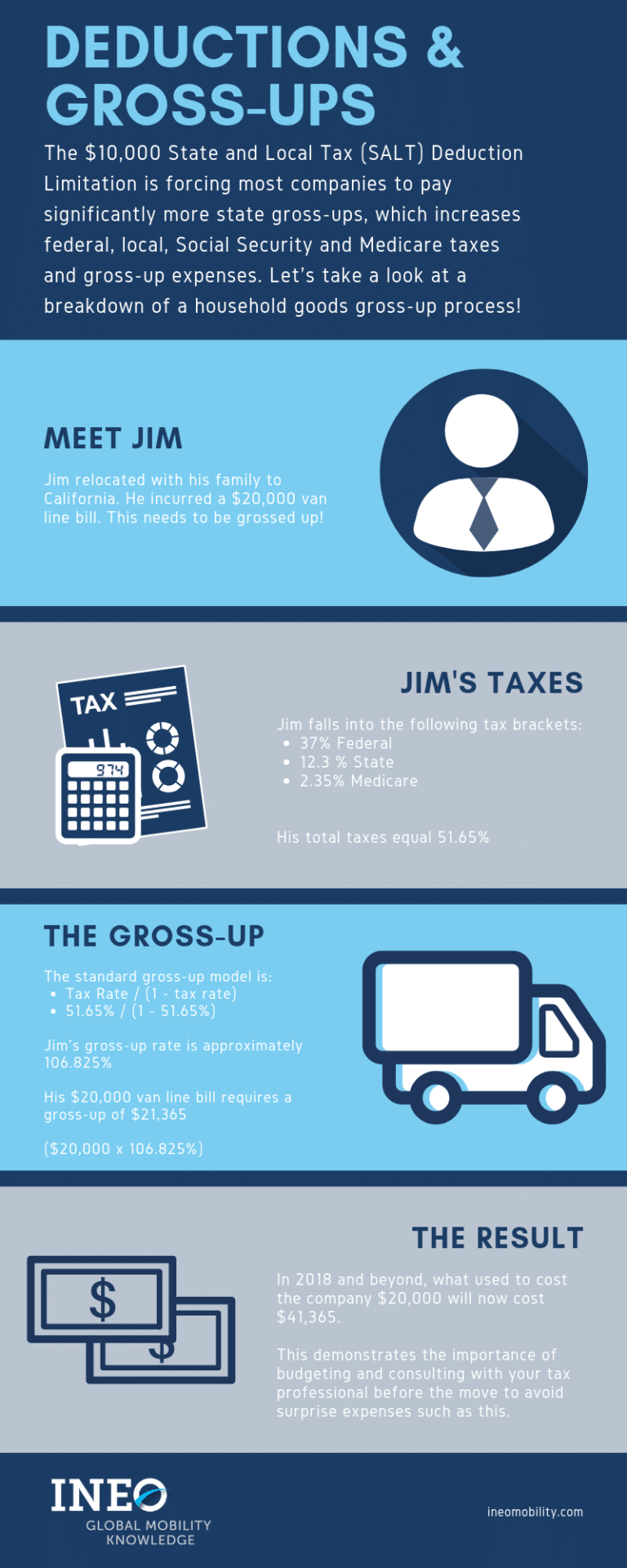

Deductions and Gross-Ups

The good news, there are still many ways to reduce gross-up costs. Offering pre-move tax consulting services and post-move tax preparation services is the best way to implement cost-saving strategies. Being proactive about the realities of gross-ups and expense tracking in the aftermath of tax reform will allow you to appropriately budget for and anticipate unexpected expenses and maximize your mobility program’s dollars. A record number of corporations took advantage of Ineo’s gross-up audits and tax preparations services for the 2018 tax year. Evaluate how your company’s mobility programs and budgets were affected by the changes and consider optimizing your budget by requesting an evaluation of your relocation policies by our tax experts. You may want to consider using Ineo’s gross-up audits and tax preparation services prior to 2019 year-end.

Work closely with your Relocation Management Company (RMC) to save money by ensuring their invoices break out the service fees from the actual HHG costs. Service fees are generally nontaxable expense, HHG costs are taxable. See IRS Revenue Ruling 72-339 and Revenue Ruling 2005-74. Verifying that the RMC is breaking out the non-taxable service fee from other tax-reportable moving expenses may mean significant cost savings on gross-ups and your transferee’s tax liability.

How States are Reacting

Some states have chosen not to align their tax laws with the federal laws but retain the pre 2018 tax regulations. As of the date of publication of this article, in tax year 2019, there are seven (7) states that remain non-conforming, they are:

Arkansas, California, Hawaii, Massachusetts, New Jersey, New York and Pennsylvania.

Here are examples of how some of these states are treating relocation expenses:

- CA requires CA Form 3903 to be used to deduct moving expenses;

- HI recently to conformed certain aspects; however, they remain non-conforming with regards to the treatment of moving expenses;

- NJ requires moving expenses be excluded from income – NJ 1040 line 7;

- NY requires moving expenses be excluded from Federal AGI on the NYS tax return.

Companies will not need to do a state gross-up for certain HHG expenses if the employees home state is one of the seven mentioned. It’s critical for employers to review W-4 information and state withholdings to be sure they are correct. Failure to audit this information can cost your company or your employees thousands of dollars in taxes and gross-ups or conversely possible fines for under withholding.

In Conclusion

Guidance and planning with tax professionals, at both the corporate and employee level, generally results in cost savings to the company, tax savings to employees, and improved transferee satisfaction and retention. Companies who relocate employees and/or send their employees on temporary assignments and extended business travel are wise to consider offering US Domestic pre-move tax consultations and/or tax return preparation services to help maintain the strong bond between talent management, mobility, and tax. A successful program not only maximizes their budget and cost savings, but also enhances the employees’ experience and satisfaction.

Want to know more?

Sign up for our 32nd Annual Mobility Tax, Legal & Payroll webinar to learn more about how the industry reacted to the tax law changes and best practices for reviewing your policy. Register today!

Global Mobility Resources

Learn more about what’s going on at Ineo and insights into the complex world of global mobility from the industry’s top thought leaders and innovators.

Request A Demo

Whether you are new to the world of global mobility or you’ve been in the business for a while, Ineo is here to assist you.

The best way to learn how Ineo’s global mobility software can help your company revolutionize your global mobility program and support your business strategy is to see it in a demo.

Fill out this form to get started today.

Get Started